As 2023 comes to an end and the holidays quickly approach, the L&B LAB looks back on how our industry performed this past year and where our forecasters see it heading as we enter 2024

2023 – A Record Year

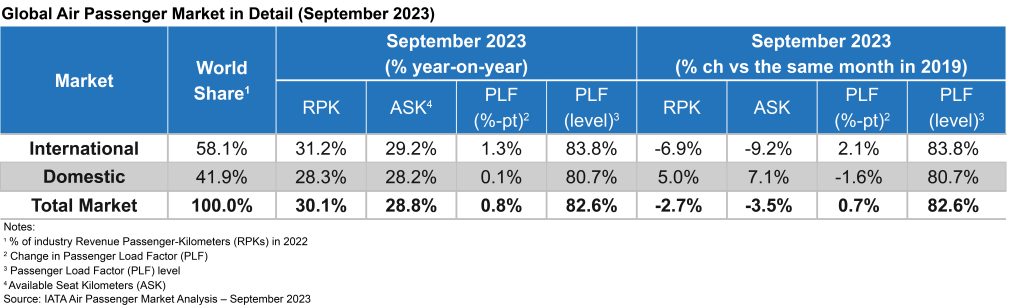

Air travel in many parts of the world exceeded 2019 volumes in 2023. According to IATA’s September 2023 Air Passenger Market Analysis (the most recent report available), worldwide domestic air travel is 2.7% below 2019 volumes, while domestic travel in the United States (U.S.) is up 5%. International travel remains down almost 7%. Despite some sectors not returning to pre-pandemic volumes, travel volumes, which are measured by revenue passenger-kilometers (RPKs), are 30% higher than September of 2022. Further, the trend remains strongly upwards. 1

The return of international air travel was uneven because some countries (principally China and Japan) are still experiencing slow recovery in their international sector. This is mainly due to the delay in lifting their COVID-19 travel restrictions. As a result, international travel between Europe and Asia, North America and Asia, and within Asia are more than 30% lower than 2019. Travel from Asia to Australia and New Zealand is still 20% lower than 2019, too. However, travel across the Atlantic Ocean and to the Middle East has exceeded 2019 volumes.

The growth of air travel in 2023 was led by a return of tourism. As of April 2023, worldwide tourism is about 87% of December 2019 volumes. Only Asia (excluding China) is still below December 2019 volumes, which is driven by the lack of Chinese visitors. Spring 2023 volumes to Europe and the UK were well above 2022 and the summer season exceeded 2019. Spring 2023 tourism to Asia (excluding China) tripled 2022 volumes.

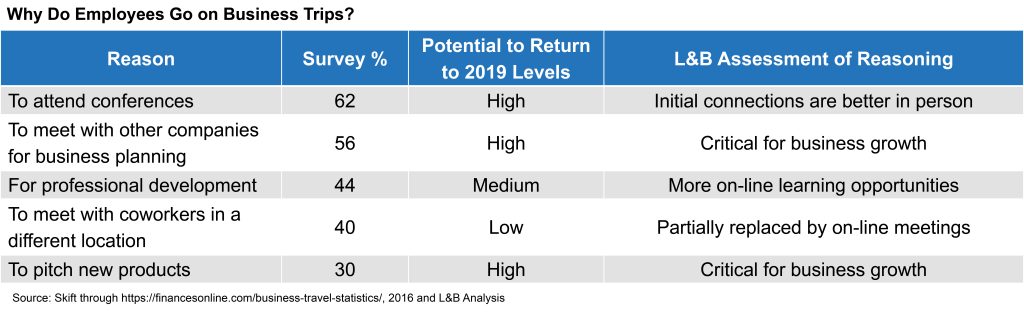

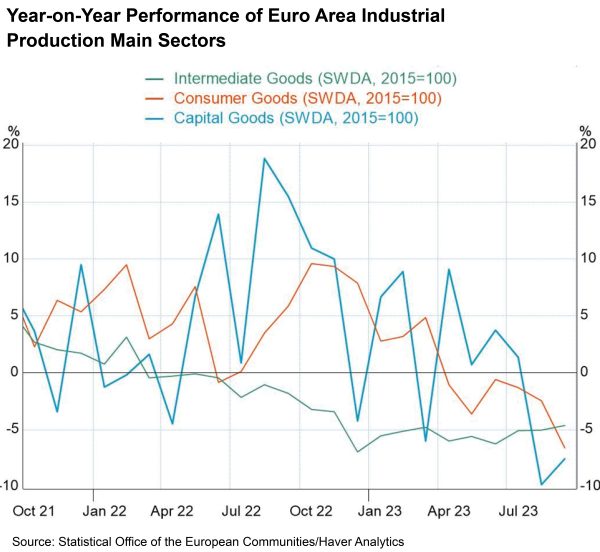

Interesting to note, European businesses saw a year over year decline in production from 2022 to 2023, while U.S. businesses saw increases in production in 2023. Predictions indicate that business travel may never return to pre-pandemic levels. The pandemic greatly accelerated a pre-existing trend to use virtual meeting and conference tools, thereby reducing business travel expenses without reducing interactions with teammates and learning opportunities. On the other hand, domestic travel for conferences, business-to-business planning, and sales have likely already returned to pre-pandemic levels, where face-to-face interactions are more essential.

The convergence of the declining European business production with increased tourism demonstrates that a portion of the 2023 demand is a result of postponed travel from the years 2020 to 2022. Similarly, much of the rise in Asian tourism can be attributed to pent-up demand from the same period.

According to IATA, airline load factors in September2023 were 82.6%, compared to 81.9% in 2019. Airlines persist in distributing their capacity to routes that ensure their aircraft remain in operation and maintain a satisfactory passenger occupancy.

What’s Next in 2024

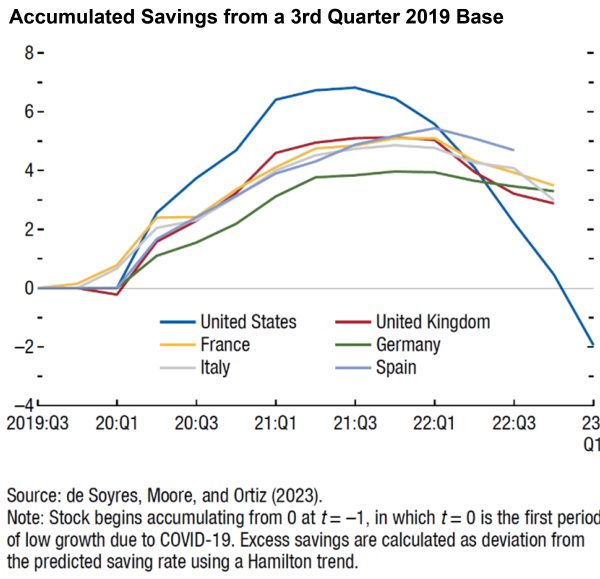

Two major trends will shape aviation demand in 2024. First, European and U.S. economic growth will continue to slow faster than emerging markets and developing economies. Chinese growth will continue to slow, impacted by weakening performance and overall confidence in its economy. This in turn will reduce employment and limit personal travel. Second, pent-up demand from the pandemic in the U.S. will have been served as passengers will have spent down their savings accumulated during COVID-19. In Europe, the spend down of savings has been slower and some pent-up demand will still drive travel in 2024. In Asia, pent-up demand is just beginning to drive travel demand in 2023 and will continue to in 2024.

The pandemic greatly accelerated the use of teleconferencing for professional development and intra-company meetings. Many of these business travel changes are likely permanent. These trips, when they do occur, will likely include a mix of both leisure and business activities and will be longer. Airlines have already acknowledged that their passengers are making these types of combined trips.

Slowing U.S., European and Chinese Economic Growth

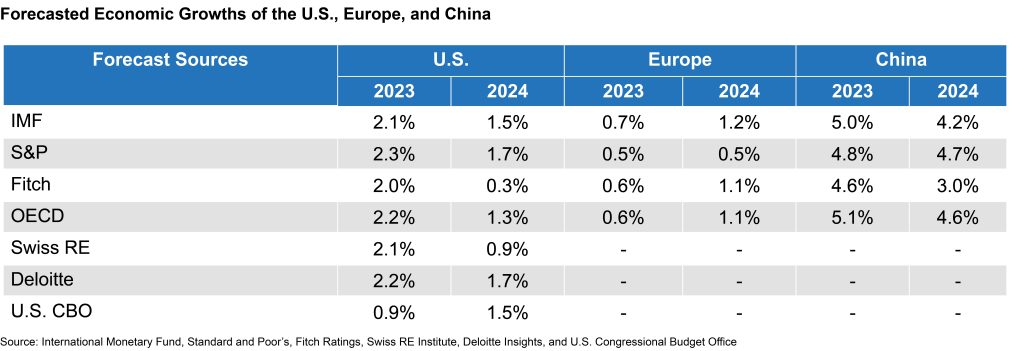

According to the International Monetary Fund (IMF ), European economic growth was driven by the services sector, driven primarily by strong tourism. As pent-up demand for tourism dissipates, growth in economic activity in the services sector will also slow. Manufacturing was already slowing down and is expected to be weak into 2024. The U.S. economy was already strong in many sectors through the third quarter of 2023. However, the consensus of many forecasts is that U.S. economic growth will slow starting in the fourth quarter of 2023 and continue slowing to 0.9% to 1.7% in the first half of 2024. European economies will start to recover in 2024, but economic growth will be slow – in the 0.5% to 1.2% range. The Chinese economy will slow in 2024 to a growth rate between 3.0% and 4.7%. The slowdowns in Europe and the U.S. are partially driven by high interest rates, which were raised by central banks to slow inflation. The slowdown in China is due to issues with debt in the property development businesses and rising youth unemployment rate eroding confidence in the economy. While inflation will have slowed in Europe and the U.S, it will still be above the target rates established by central banks. These interest rates will remain comparatively high until inflation further eases.

Pent-Up U.S. Demand from the Pandemic Has Been Served

Outside of Asia, the aviation industry has accommodated much of the pent-up demand for travel from the pandemic years of 2020 through 2022. This demand was fueled by an accumulation of savings during the pandemic. According to the IMF, the U.S. has spent down this accumulation of savings to 2% below levels observed in 2019. The Europeans have held on to savings, and their pent-up demand for travel will carry over into 2024. Thus, U.S. rates of discretionary travel will return to historical levels. European travel will continue to be above historical levels through 2024. Asian travel is still recovering from the pandemic, and discretionary travel should grow well above 2023 levels. The coming year will likely challenge airlines worldwide financial performance, especially in an environmental of slowing demand growth combined with a greater supply of airlines seats

To read more about four specific travel markets in 2024, please continue to the case studies that follow this article. Our four case studies cover a wide range of air travel frequency of usage. According to Airbus’s Global Market Forecast (GMF), propensity to use air travel in India stood at about 0.1 trips per person in 2019 compared to 0.5 in China, 2.1 in the U.S., and 3.1 in Australia.

What is the L&B LAB?

The LAB is Landrum & Brown’s research and development unit. Our mission is to harness decades worth of industry knowledge and expertise to develop innovative solutions that support our clients along with promoting industry thought leadership.

This document was prepared by Landrum & Brown, Inc. | [email protected]

Sign up to receive our next L&B LAB in your inbox!